Calendly for Banking & Lending

Win more clients with automated scheduling

Speed up your lending lifecycle and serve clients faster with seamless scheduling that gives banks and lenders a competitive advantage.

Churchill Mortgage achieved 1,037% ROI with Calendly

Find out how Churchill Mortgage streamlined scheduling and delivered a sophisticated digital experience that let clients instantly connect with a loan officer in their area.

1,037%

ROI

415%

labor cost savings

26,767

hours reclaimed (and counting)

Build your competitive edge with fast, efficient scheduling

Protect your business and your reputation

Enterprise-grade security and controls including Domain Control, SAML-based SSO, SCIM provisioning, activity logs, and more

Maintain FINRA and SEC compliance with email and SMS communication archiving and safeguard client data with our data deletion API

Calendly follows FINRA and GLBA guidelines, is ISO/IEC 27001 and SOC 2 Type 2 certified, and PCI and GDPR compliant

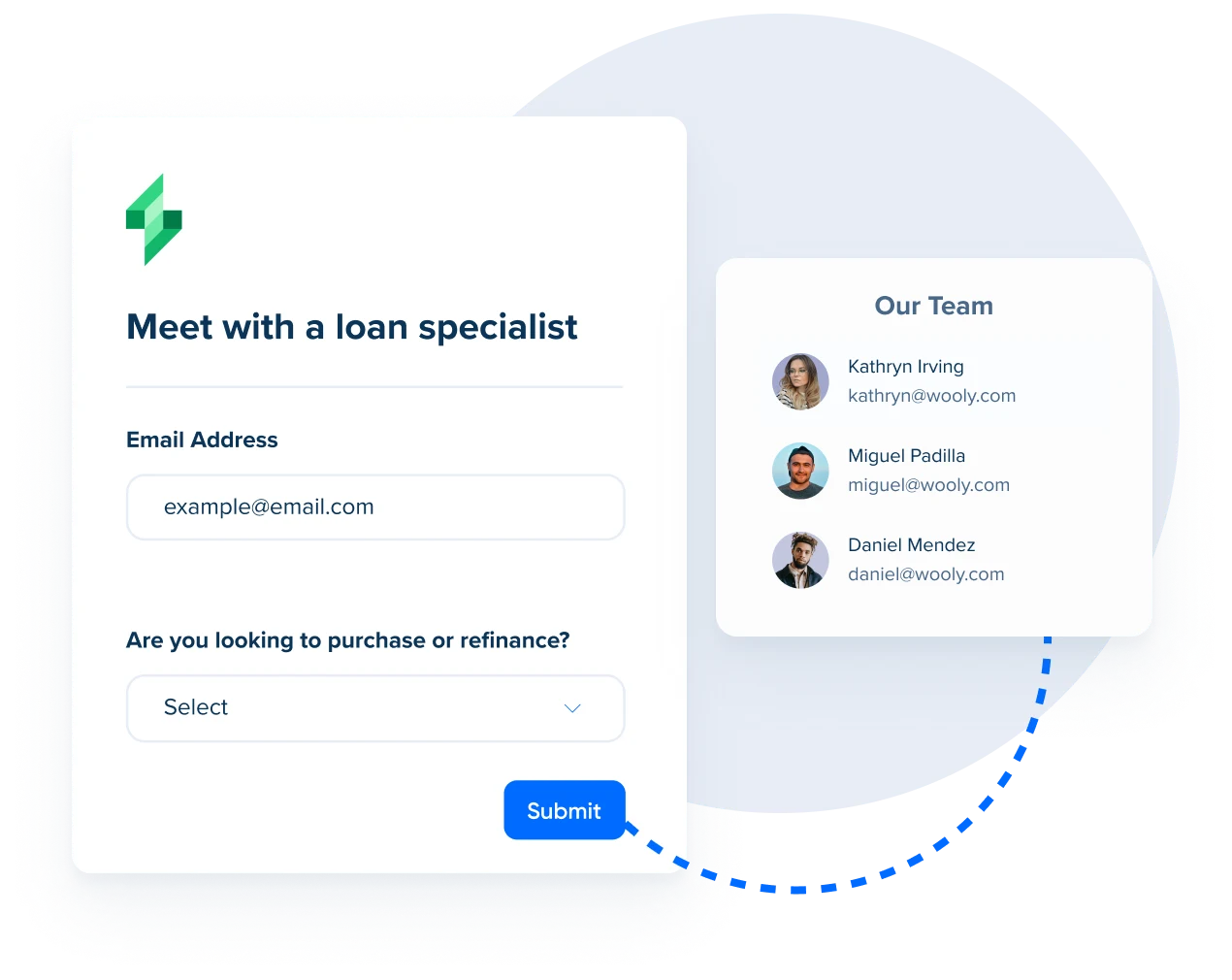

Be the first lender to respond

Meet with new clients before a competitor does by embedding Calendly anywhere on your website, such as your “find a loan officer” or branch locator page. Automatically route them to the first available loan officer licensed in their state or an expert best suited to assist with specific services, such as completing a loan application or opening a new account.

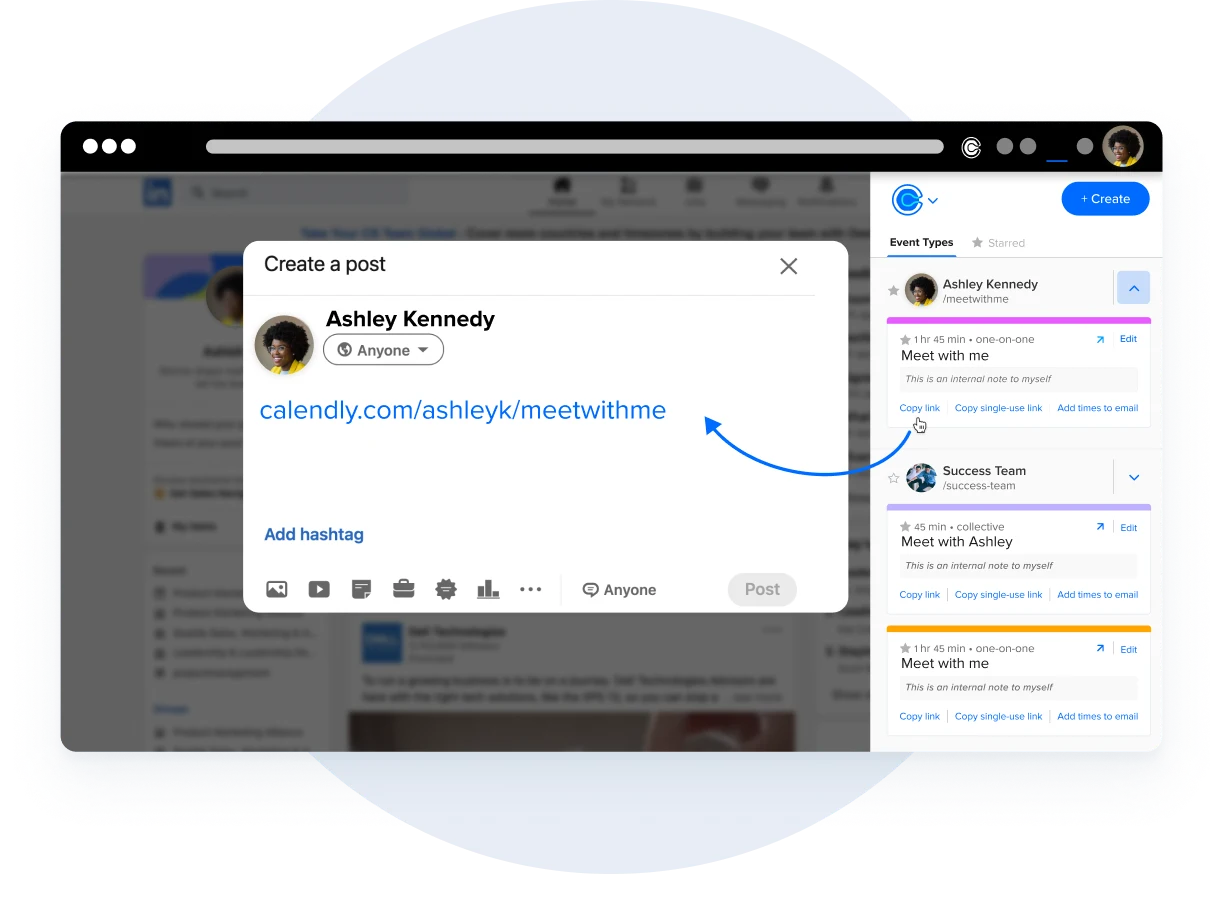

Strengthen relationships throughout the lending lifecycle

Include your scheduling link in outbound emails and make it easy for clients to book appointments when they want to take out a new loan, have questions about their loan application, or want to refinance. Easily embed available appointment times in emails directly from your inbox, share your scheduling link from your web browser, and include your calendar availability in LinkedIn conversations.

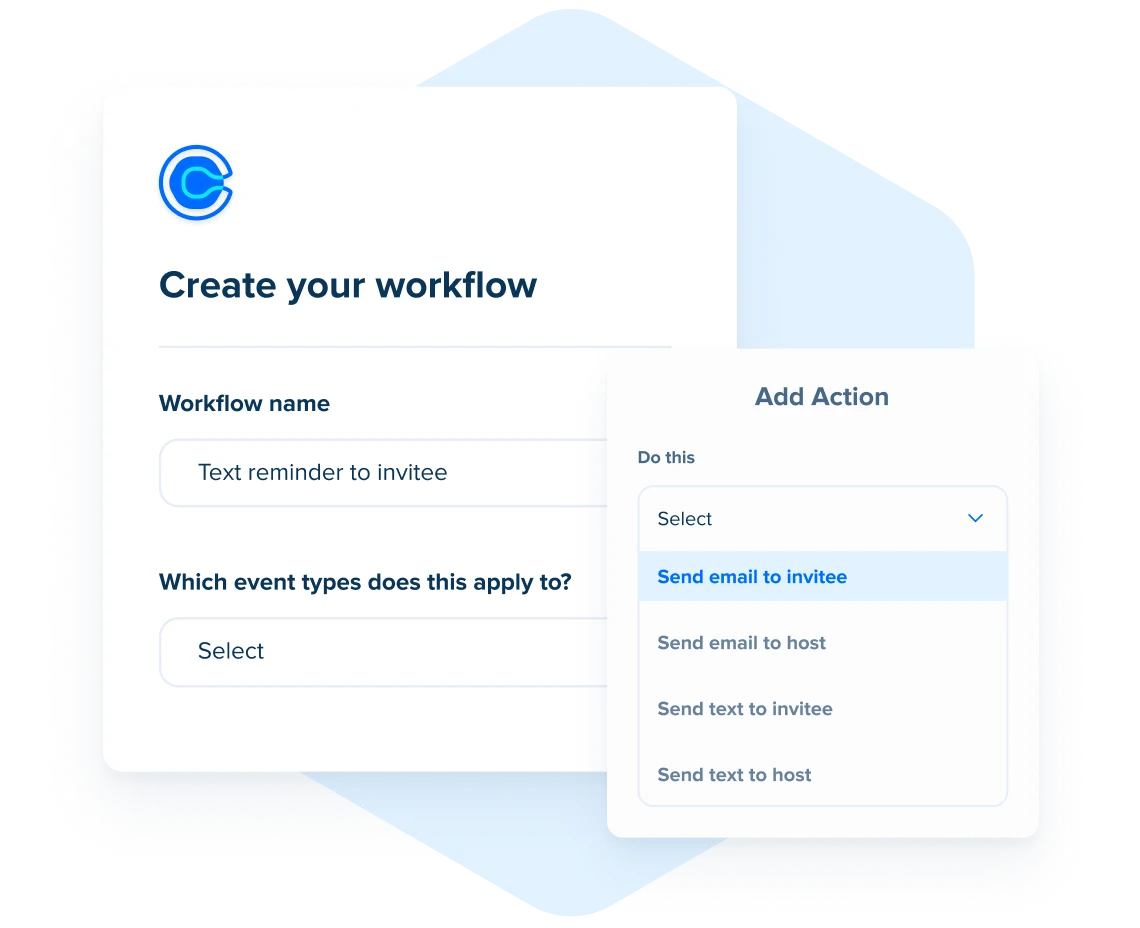

Serve more clients while providing exceptional service

Manually sending appointment reminders is a thing of the past. Ensure clients show up to their appointment by automating reminders and reconfirmations via email or SMS so loan specialists and bankers can focus on helping clients open new accounts or lines of credit, verify interest rates, refinance their mortgage, and more.

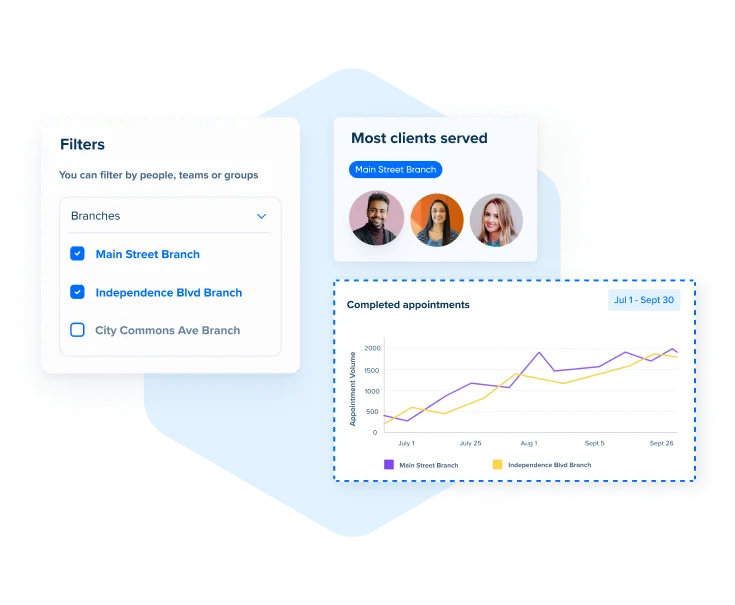

Deliver the services your clients need

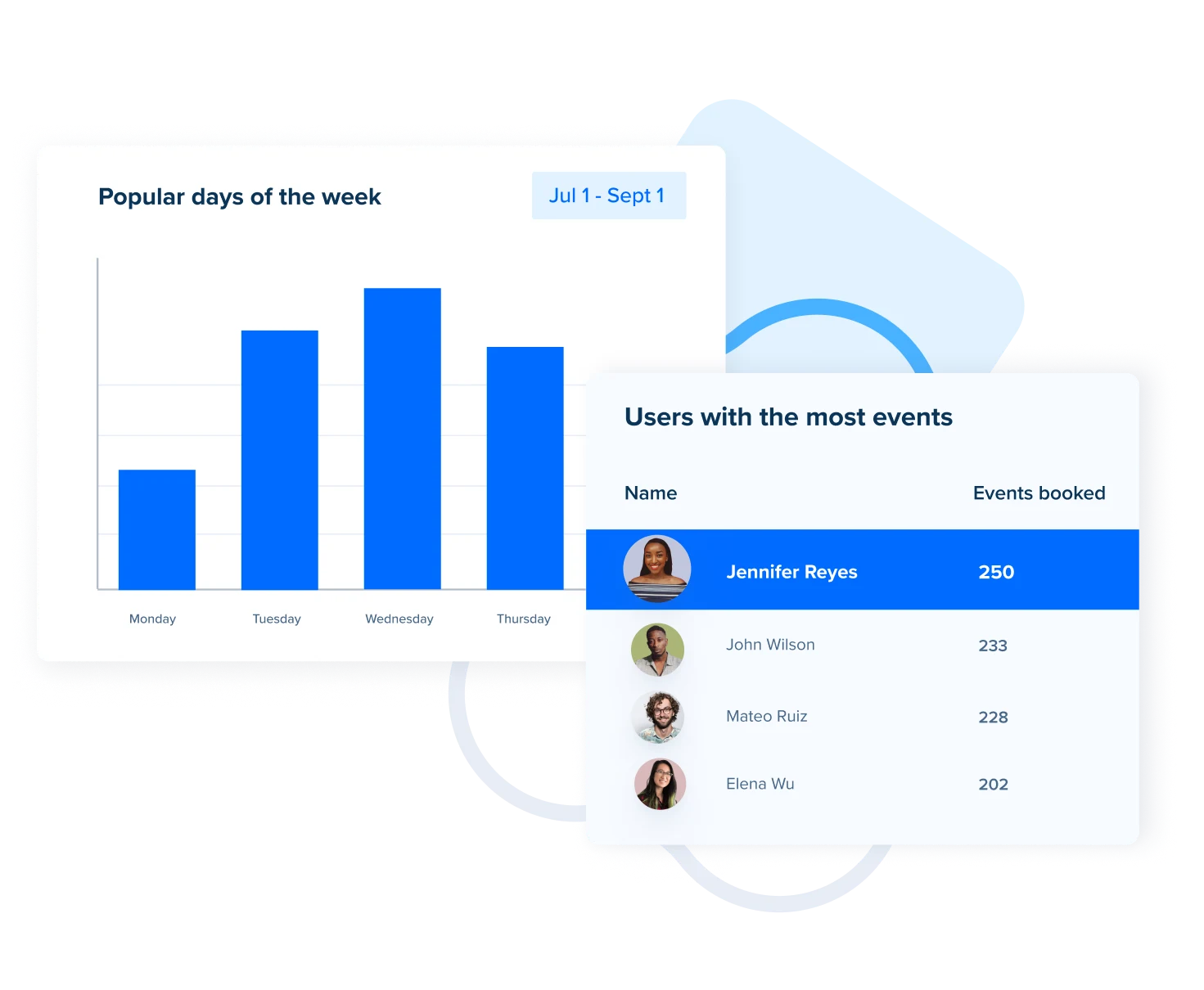

Use data to plan day-to-day availability and ensure each branch staffs the necessary experts based on the number and type of appointments scheduled. Quickly identify trends and discover your most popular appointment days and times at each location.

“Calendly lets you truly customize the way you interact with customers. Within a large company, you can keep it simple or you can go in-depth and make it do whatever you want. Either way, you get incredible benefits.”

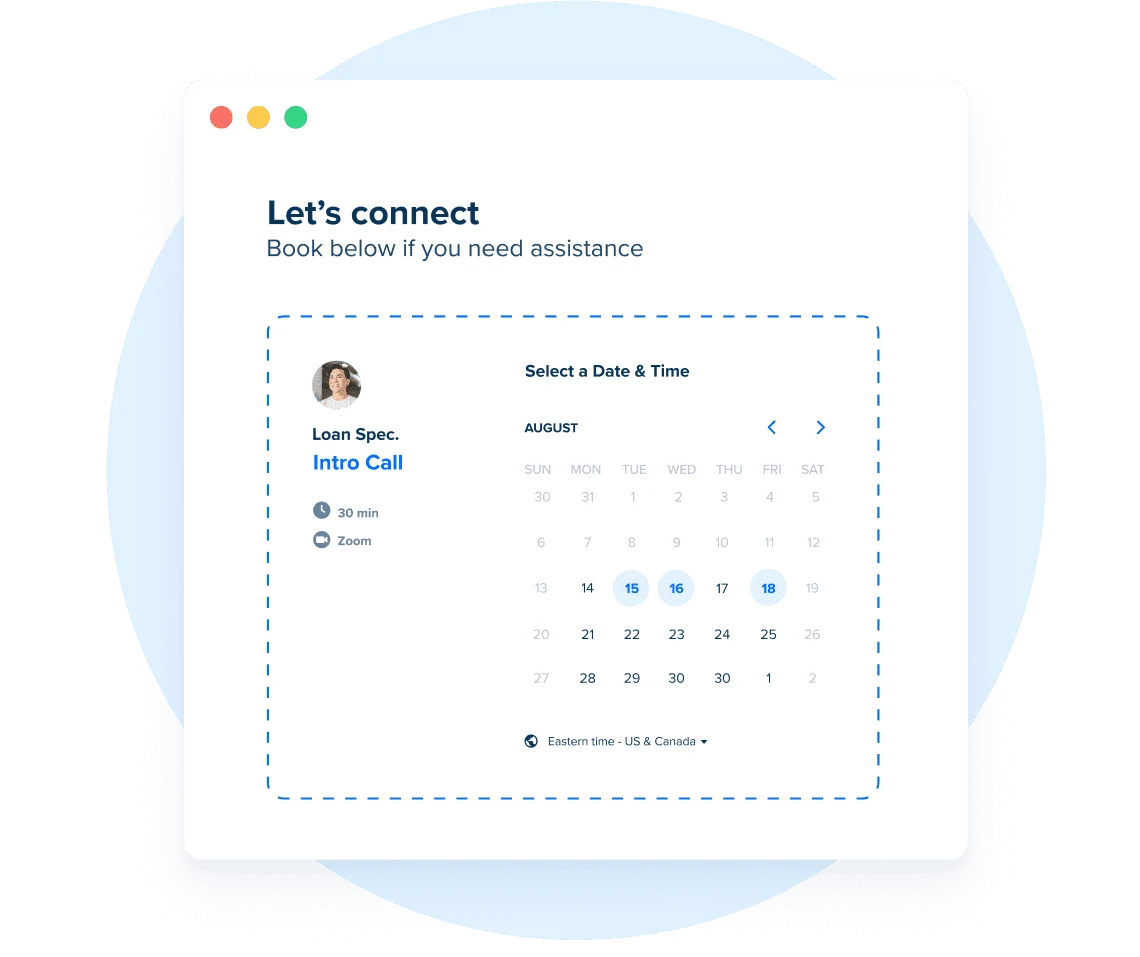

A simplified scheduling experience

Embed Calendly

Add Calendly anywhere on your website, such as on your “find a loan officer” page, branch locator page, or client portal, so they can easily self-schedule appointments whenever they want.

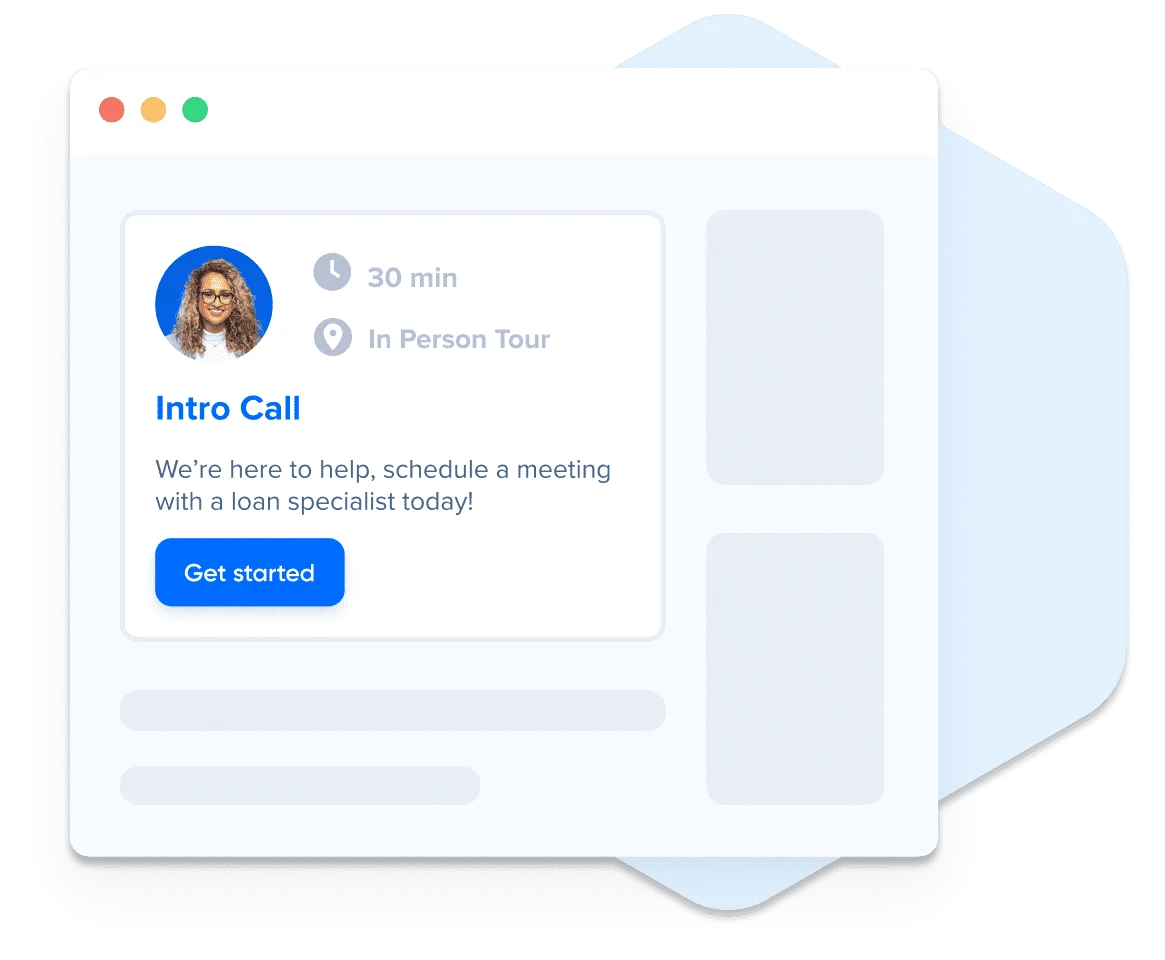

Connect with prospective clients faster

Instantly book qualified clients from your website and route them to the loan officer, banker, or other expert best suited to assist them.

Automate communications

Automatically send personalized, fully compliant emails before and after appointments to reduce no-shows and build long-lasting relationships.

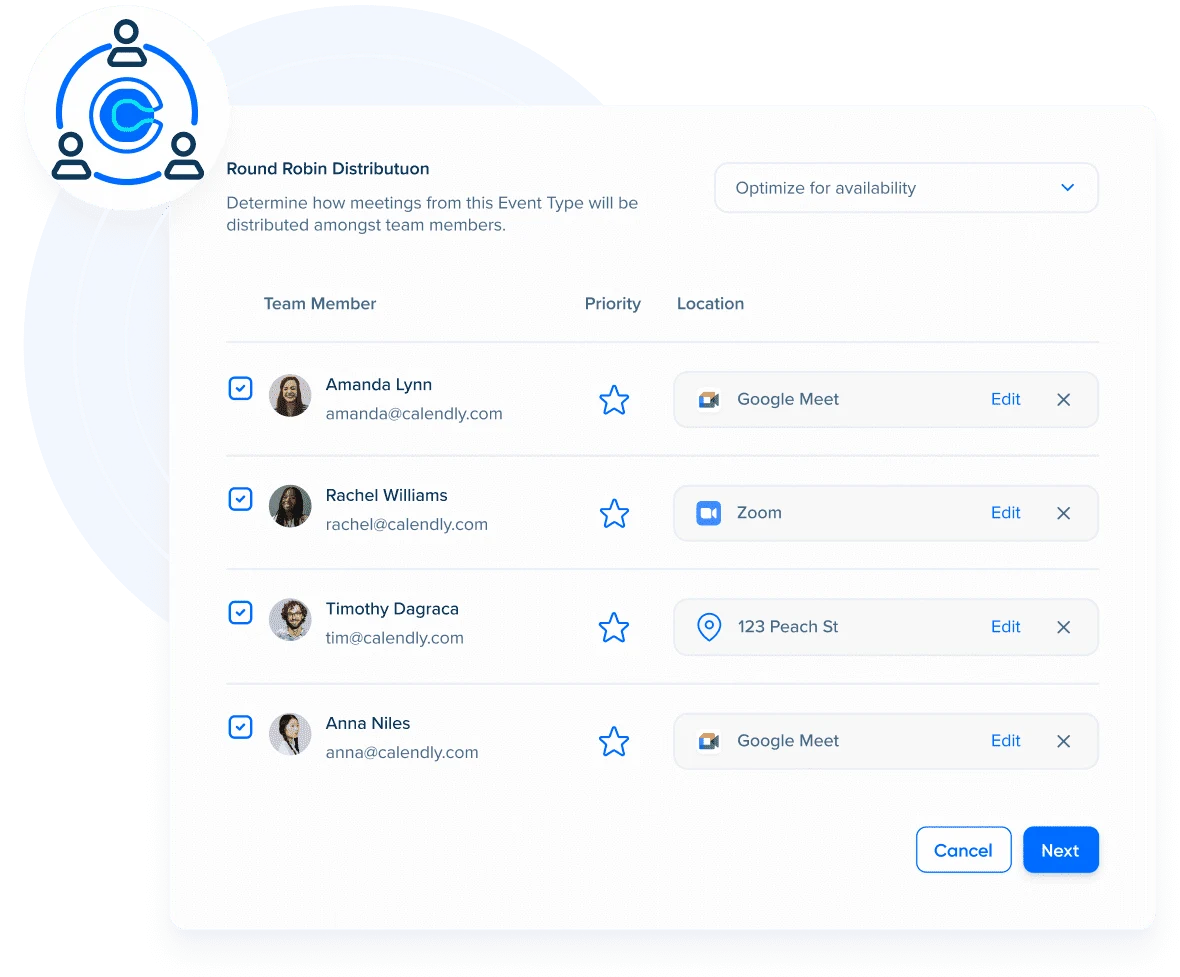

Meeting options to fit your needs

Create a booking page with options to discuss different products, set up a Round Robin to automatically pair clients with the next available expert, and easily schedule appointments with multiple stakeholders.

Make decisions based on data

Identify top performing loan officers, review your most popular client-facing appointment types, optimize banker availability based on data, and more.

Integrate with your existing tech stack

Connect your calendar, video conferencing tool, Salesforce or other CRM, and more to boost productivity and eliminate manual tasks.

Hear it from our customers

Pricing Plans

Choose a plan that’s right for your needs.

When your team needs to align on a scheduling process and collaborate efficiently.

/seat/mo

For teams who need enterprise-level security, admin control, and support. Includes enterprise-grade procurement.

Starts at

$15k/yr